New bubble . com is coming???

November 27, 2023

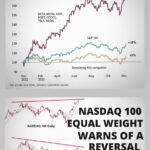

The S&P500 just hit a new 52 week high despite

December 11, 2023Canada is struggling with a severe credit crunch

The Canadian economy has undergone a massive deleveraging process. Over the past two decades, a major part of the growth of the Canadian economy has been due to the increase in credit, especially in the housing sector, and its consequences have been evident when interest rates have reached high levels.

The data shows that the growth of household credit has been accompanied by a significant decrease in the year ending September, a rate that has not been seen in the last 30 years. In fact, consumer credit has decreased by 1 percent, which is the cause of inflation.

Interestingly, the last time Canada faced such dire conditions was during the severe recession of 1990, which was attributed to staggering interest rates and unemployment of 14 and 12 percent. The current contraction in household credit, coinciding with a staggering unemployment rate below 6%, is unprecedented and will therefore be very important in Canada's upcoming employment report. Any significant weakening of employment may exacerbate the downturn in Canada's credit cycle.

#fundamental_analysis #financial_markets

#world_markets #US_stock_index #Canada